Tutorials

Find here all the answers to your question.

Copier Settings

This section contains multiple settings that will define the behavior of your Trade Copier, from computing the trade size, and enabling common features such as SL, TP, and Pending, to set advanced filters and settings.

-- Just click the Copy Settings button and click Adv. Settings.

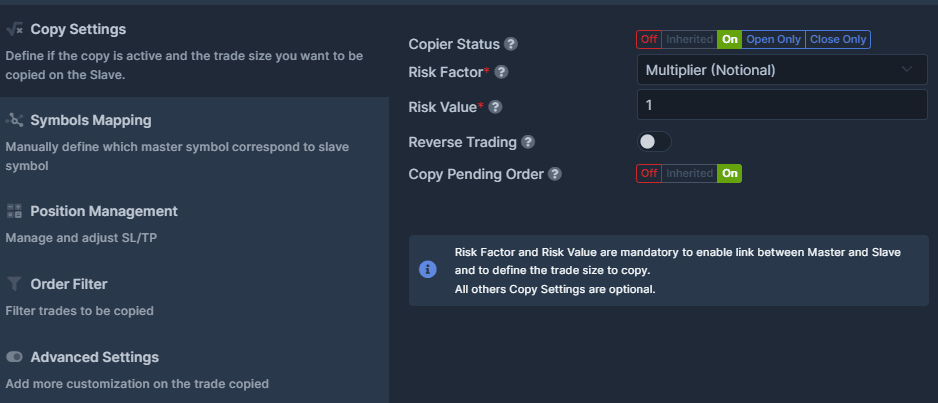

Copy Settings

The Copy Settings define what will be the trade size copied on the slave.

Auto Risk: The Slave trade size is proportional to the Master trade size and the Master account size. The Auto Risk method allows you to be exposed to the same level of risk between the Master and the Slave proportionally to the account size.

When using the Auto Risk method, the system will keep the same ratio of the trade size versus the account size between the Master and the Slave accounts. This is how we compute Auto Risk:

Slave Order Size = Master Order Size/ Master Account Size x Slave Account Size x Auto Risk Value

The “Account Size” can be defined using the equity, the balance, or the free margin of both Slave and Master accounts.

Examples:

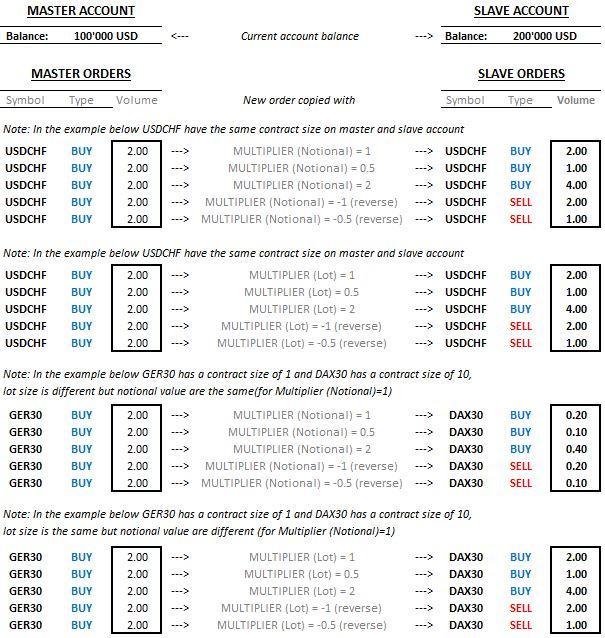

With the Multiplier method, the Slave trade size is simply a multiplier applied to the Master trade size no matter the Equity, Balance, or Free Margin of both Slave and Master accounts. When using the “Multiplier (Notional)” or "Multiplier (Lot)" methods, the system will multiply the master trade size by the defined value and place the corresponding order on the Slave account.

Multiplier (Notional)

Using the "Multiplier (Notional)" the contract size of master and slave symbols is considered and trade size will be adjusted accordingly. The multiplier will be applied to the notional amount of the master trade size.

This is how we compute Multiplier (Notional): Master lot size x Master contract size x Multiplier(Notional) / Slave contract size = Slave lot size

Multiplier (Lot)

Using the "Multiplier (Lot)", the contract size is not considered, so if it is different between master and slave symbols, the notional amount of the trade will not be the same.

Here is how we compute it: Master lot size x Multiplier(Lot) = Slave lot size

Examples:

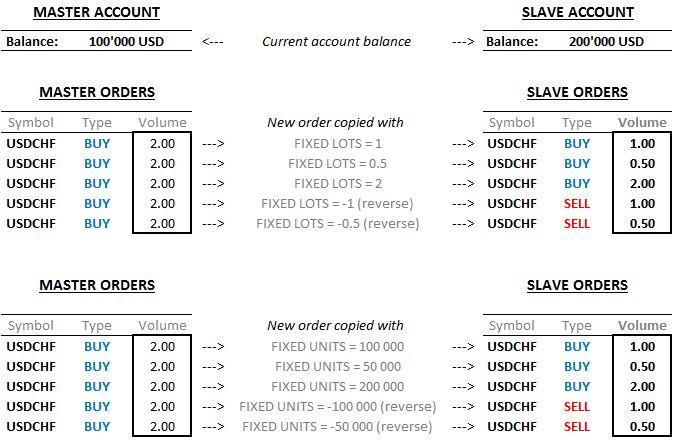

With Fixed Lot/Unit the Slave trade size is fixed and is defined in advance for each trade no matter the Equity, Balance or Free Margin of both Slave and Master accounts

When using the Fixed Lot or Fixed Unit method, whatever the Master trade size is, each trade placed on the Slave account will be the defined Fixed lot or Fixed Unit value, no matter the Equity, Balance, or Free Margin of both Slave and Master accounts.

Please note that if you are using a broker account configured with a mini, micro, or standard lot, setting a "Fixed Lots" with a value of 1, will open respectively 1 mini, 1 micro, or 1 standard lot.

Difference between Lot and Units

100,000 units represent the equivalent of 1 standard lot with a notional value of 100,000 USD, so for example, if you set the Fixed Units to 20,000 this is equivalent to 0.2 standard lot.

Examples:

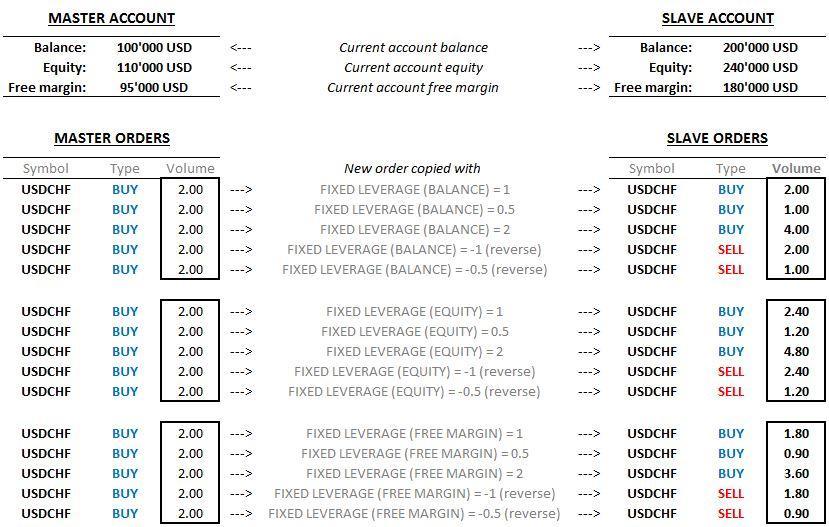

With Fixed Leverage the Slave trade size is fixed and is a defined function of a wished leverage that the trade has to have on the Slave account. The Slave lot size does not depend on the Master trade size in that case.

Below is the formula used to compute the slave order size:

Slave order size = Slave "Account Size" x "Fixed Leverage" Value

When using the “Fixed Leverage” method, the system will compute the order size to place on the Slave account defining the leverage that the new position has to have regarding the account size of the Slave account.

Examples:

The Copier Status default is always ON. If you wish to temporarily stop the copy of a particular Master or Slave account, you can change the status to OFF. Please note that if you change the Copier Status of a Master account, all Slaves linked to that particular Master will stop copying its orders.

You can "Reverse" your trades by simply enabling the Reverse Trading option. If the Reverse Trading option is enabled, a buy order will become a sell order and vice versa. The same effect happens for Stoploss & Takeprofit, SL becomes TP, and TP becomes SL on the Slave.

You have the option to copy pending orders of the Master or not.

If you activate the "Copy Pending Order" option, the pending orders will be hosted on the Slave at the creation of the order. This means you'll have a pending order on your Slave account as soon as your Master placed a pending order.

If the Copy Pending Order is disabled, a market order will be sent to the Slave after the Master pending order is triggered/hit.

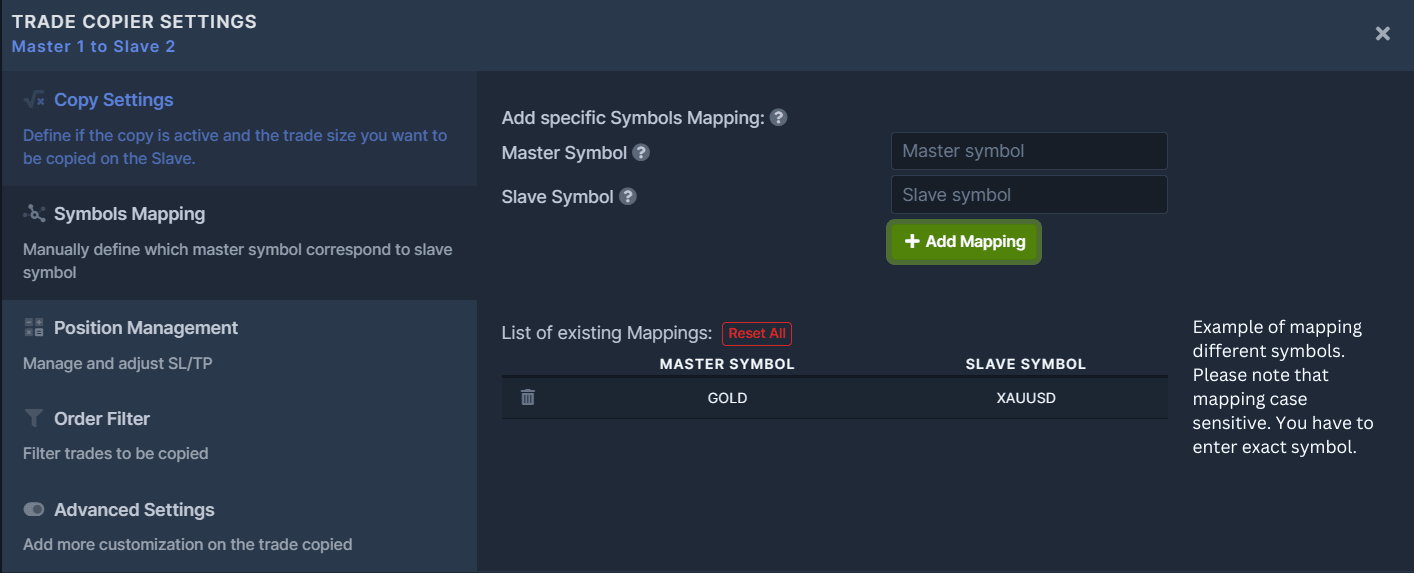

Symbols Mapping

Symbols Mapping is used if the symbol difference between the master and slave is too complex.

Symbols Mapping is used if the symbol difference between the master and slave is too complex.

By default, our Trade Copier is able to automatically define the suffix by itself. For instance EURUSD to EURUSDm or USDCHF to USDCHFpro,. However, for complex symbols like XAUUSD to Gold or XTI to Oil, etc. you will need to use the "Symbols Mapping" functionality. It will allow you to define which Master symbol corresponds to which Slave symbol.

To map, you would need to enter the EXACT symbol of the Master and the Slave. Please note that mapping is case-sensitive.

If you wish to define a different setting for a specific symbol, please read our tutorial about Symbol Settings.

Position Management

Positions Management settings can be set up on the Master or Slave. Regardless of where you set it up, the settings you have entered will be synced in both views (Master and Slave).

You can copy and host your Stop Loss and Take Profit on the Slave account.

By enabling the Copy Stop Loss and Take Profit feature, the Stop Loss and Take Profit on the Master will be copied and hosted directly on the Slave at the order creation. If this is disabled, as soon as the SL/TP is triggered on the Master, it will send a Market order to the Slave to close the position.

** A paid plan is required to enable this function**

By enabling the Copy Stop Loss Updates or Copy Take Profit Updates, all SL/TP updates made on the Master will be copied and hosted on the Slave.

If this is disabled, no SL/TP updates will be copied; however, as soon as they are triggered on the Master, the positions on the Slave will close with a Market order. To prevent the closing of Slave positions in such cases, you can enable "Copy Open Order Only" in the Order Filter tab.

The Maximum Risk will define the maximum percentage, amount, pips, or decimal of your balance to risk per trade. If no Stop Loss is defined, the Trade Copier will compute the Stop Loss to add according to the trade size and Maximum Risk defined. If a Stop Loss is defined at the creation of the order on the Master and if that Stop Loss leads to a higher potential loss than the Maximum Risk defined, the Trade Copier will override that Stop Loss in order to respect the Maximum Risk defined.

The value entered corresponds to the type you have selected. For example: if you enter the value of 25 and selected % as the type, the Maximum Risk will be 25% of your Slave balance. If you’ve selected “Cash Amount”, then the entered value would be based on the currency value of your account.., ie $25.

Fixed SL/TP can be defined as a percentage, cash amount, pips, or decimal of your Slave balance.

The value entered will put a fixed number to use for Stop Loss or Take Profit in all trades placed on the Slave. By defining a value & type in these functions, any Stop Loss or Take Profit set on the Master will be ignored.

Minimum SL/TP can be defined as a percentage, cash amount, pips, or decimal of your Slave balance.

The value entered sets the minimum Stop Loss and Take Profit allowed on the Slave. Please note that if you have defined a value on the Fixed SL or TP fields, it will override the Minimum SL or TP.

Maximum SL/TP can be defined as a percentage, amount, pips, or decimal of your Slave balance.

The value entered sets the maximum stop loss or take profit allowed on the Slave. Please note that if you have defined a value on the Fixed SL or TP fields, it will override the Maximum SL or TP.

Trailing Stop can be defined as a percentage, amount, pips, or decimal of your Slave balance. It applies a Trailing Stop to all orders, overriding and ignoring any Stop Loss specified by the Master.

Order Filter

The Order filter can be set up on the Master or Slave. Regardless of where you set it up, the settings you have entered will be synced in both views (Master and Slave).

Please note that Open Order Only and Close Order Only cannot be activated together at the same time. Activating Close Order Only will automatically deactivate Open Order Only, and vice versa.

Copy Open Order Only

By enabling Copy Open Order Only function, the Trade Copier will only copy open & pending orders (if copy pending order function is enabled), while all close orders will be ignored.

Copy Close Order Only

By enabling Copy Close Order Only function, the Trade Copier will only copy closed orders, while all open and pending orders will be ignored.

Please note that Copy Buy Order Only or Sell Order Only cannot be activated together at the same time. Activating Buy Order Only will automatically deactivate Sell Order Only, and vice versa.

Copy Buy Order Only

By enabling the Copy Buy Order Only function, the direction in which the Trade Copier will place trades is restricted to copy buy orders only. Sell orders will be ignored.

Copy Sell Order Only

By enabling the Copy Sell Order Only function, the direction in which the Trade Copier will place trades is restricted to copy Sell orders only. Buy orders will be ignored.

The value entered on the Filter Minimum Order Size or Filter Maximum Order Size field sets the Minimum or Maximum order size allowed to copy. If the calculated order size is smaller than the Filter Minimum Order Size value or greater than the Maximum Order Size, the Trade Copier will ignore the order.

The Filter Comment function lets you filter orders using the comment function. Only orders with the specified comment will be copied to the Slave.

Trading Hours (24 H)

The Trade Hours function lets you control the times of each day when the Slave is allowed to copy trades. Please note that the time is based on CET. Any incoming orders outside these times will be ignored.

Trading Days

The Trading Days function lets you control the days when the Slave is allowed to copy trades. Any incoming orders outside these days will be ignored, Day periods are defined with the CET timezone. You can select toggle the buttons representing the days (Sun to Mon) to choose which days you want to copy trades.

Advanced Settings

Advanced settings can be set up on the Master or Slave. Regardless of where you set it up, the settings you have entered will be synced in both views (Master and Slave). Please note that all features under the "Advanced Settings" tab are optional. Only utilize them if it fits your strategy.

You can change the default comment on a trade (MT4, MT5, and cTrader only). FXCM and LMAX don't support this function.

The Comment feature is usually used to know which Master placed the order on a Slave account. To do that, you can enter a comment by going to your Master's advanced copy settings.

You can define a comment for each master/slave copy link, the comment will appear on the slave trade.

Please note that it is not possible to copy the comment defined on your Master trading platform directly. Duplikium's "Comment" feature only applies to the comment entered on your Trade Copier.

Please note that the comment feature is available only for accounts with a Subscription Plan.

We offer 3 ways to manage your Slippage:

Slippage control options can be set up on your Master or Slave accounts' Advanced Settings. Regardless of where you set it up, Master or Slave, Slippage control applies to your Slave account only. You can activate these options altogether at the same time; however, please remember that these settings will create parameters to qualify if an order should be processed or not. These parameters need to be respected in order for an order to go through, so creating too many parameters may lead to the majority of your orders not getting processed.

Control 1: Max Slippage (pips)

The Max Slippage (pips) value entered determines how close the slave's price needs to be to the master's entry price for a trade to be copied.

Control 2: Max Delay (in seconds)

The Max Delay (in seconds) limits the delay allowed to execute an order. If the delay on an order exceeds the Max Delay (in seconds) value, the order will be ignored/rejected.

Control is 3: Wait for Price Improvement (pips)

The Wait for Price Improvement (pips) delays the transmission of a new order to the Slave until it is in profit by the specified number of pips. The delay can lead to higher price differences between Master and Slave.

The Minimum and Maximum Order Size functions will define the minimum or maximum lot size to copy per order. NOT for accumulated positions. Please note that they don't work like a filter that will dictate whether an order should be processed or not. They will simply adjust the order size based on the min or max value you entered while respecting your broker's minimum and maximum size requirements.

What happens if the Minimum Order Size entered is greater than your broker's minimum order requirement:

If your broker's minimum order size is greater than the value entered in the Minimum Order Size field, the Trade Copier will reduce the order size to the minimum value allowed by your broker. If you do not want to round up, disable the Minimum Round-Up feature to ignore the order. Learn more about Minimum Round-Up function.

What happens if the Maximum Order Size is smaller than your broker's minimum order requirement:

If the minimum order size allowed by your broker is bigger than this Maximum Order Size, the Trade Copier copies the minimum order size. In this particular case, the system always tries to copy the trade with the minimum allowed value.

Minimum Round-Up

By default, the Trade Copier will automatically round up the order size to meet your broker's minimum order size requirement. If you do not wish to round up the order size, you can disable the Minimum Round-Up function located in your account's Advanced Settings to ignore the trade.

Here's an example: Your broker's minimum requirement is 0.1, while your calculated Slave order size is 0.08

- Round-up enabled: automatically round up the Slave's trade size to meet your broker's requirement. The order size will be rounded up from 0.08 to 0.1

- Round-up disabled: not round up the Slave's trade size and will ignore the trade.

Round Down

Round Down function determines how the computed Slave’s trade size decimal numbers would be simplified.

Here's an example: Your calculated Slave order size 0.0555

- Round down enabled: the trade size becomes 0.05

- Round down disabled: the trade size becomes 0.06

If the computed slave's trade size is bigger than the maximum lot size authorized by the broker, the order can be split into a few orders to execute the whole size in several orders.

Here's an example: Your broker's maximum order size limit is 10 lots, while your calculated Slave order size is 15 lots. Instead of this order failing for exceeding the max limit of your broker, if you activate the split order function, the Trade Copier splits the order into 10 lots and 5 lots to complete the whole 15lots.

The Maximum Accumulated Position Size function defines the accumulated position limit of a particular Master, Slave, and or Master/Slave's symbols. Depending on where you will set this up if the accumulated position size on the Slave, Master, or Master's/Slave's Symbols would exceed the entered value, the Trade Copier prevents your Slave Account from copying new open orders.

For example, if you have defined the “Max Account Position Size (Slave)” to 0.5, you will be able to have a total net position of a maximum of 0.5 lot. You can open a maximum of 0.5 lot in one direction either buy or sell, which means that you could have 0.5 lot buy and 0.5 lot sell at the same time, however, you will not be able to open a new trade.

In case you already have a buy position of 0.4 lot and you copy a new trade of 0.3 lot, this new trade will be capped to 0.1 lot in order to have a maximum account position size of 0.5 lot.

You have 4 options on where to set this up. If you combine these options altogether, the most restrictive value will be applied.

A.) Max Account Position Size (Whole Slave Account)

Max Account Positions Size is based on the Slave account level. If you choose to set up this option, please note that it will consider all orders on the Slave account, from any source, not just those created by the Trade Copier.

B.) Max Symbol Position Size (Slave Symbols)

Max Symbol Position Size is based on the Slave's symbols. If you choose to set up this option, please note that it will consider all orders & symbols on the Slave account, from any source, not just those created by the Trade Copier.

C.) Max Account Position Size per Master

Max Account Position Size per Master is based on the accumulated positions copied from a Master to the Slave. If the accumulated positions exceed the value entered, the Slave will stop taking orders from the Master. If you choose to set up this option, please note it doesn't consider orders coming from other Masters, other sources, and orders placed directly on the Slave account.

D.) Max Symbol Position Size per Master

Max Symbol Position Size per Master is based on a given symbol copied from the Master to the Slave. If the accumulated positions exceed the value entered, the Slave will stop taking orders from the Master. If you choose to set up this option, please note it doesn't consider orders coming from other Masters, other sources, and orders placed directly on the Slave account.

You can control the count or the number of orders you only want to open on a particular Slave. Additionally, you can select a parameter on where you'd like to base the counts. If the number of open or pending orders copied exceeds the value you entered on the following options, it'll prevent the Slave account from copying new open orders no matter the trade direction (buy or sell). This means both buy and sell orders are considered in the count.

Here are the options you can choose from. Please note that if you combine these options altogether, the most restrictive value will apply.

A.) Max Account Open Position Count (Slave)

Max Account Open Ppsition Count is based on the Slave account's open and pending orders. For example, if you set the value to 10, and you already have 9 open and pending positions, the Trade Copier will allow 1 more open order to go through then it'll stop copying new orders. This means you have to close orders in order to copy new ones to respect the Max Account Open Position Count.

It'll consider all the open and pending orders of your Slave account, from any source, not just those created by the Trade Copier.

B.) Max Symbol Open Position Count (Slave Symbol)

Max Symbol Open Position Count is based on the symbol count of the Slave's open and pending orders. This means if you entered a value of 5, you cannot have more than 5 open and pending orders of the same symbol. For example, if you already have 5 EURUSD and 3 XAUUSD open orders, the Trade Copier will prevent EURUSD from getting copied, while it'll still allow 2 open orders of XAUUSD.

It'll consider all the open and pending orders of your Slave account, from any source, not just those created by the Trade Copier.

C.) Max Account Open Position Count per Master

Max Account Open Position Count per Master is based on a particular Master's open and pending count. If the number of open or pending orders copied from this specific Master account to the Slave account would exceed this value, it prevents the Trade Copier from copying new open orders.

This option is most useful if you have multiple Master Accounts. It doesn't consider orders coming from other Masters, other sources, and orders placed directly on the Slave account.

D.) Max Symbol Open Position Count per Master

Max Symbol Open Position Count per Master is based on the symbol count of the Master account. If the number of open or pending orders copied from this specific Master account to the Slave account exceeds this value per symbol, it prevents the Trade Copier from copying new open orders.

It doesn't consider orders coming from other Masters, other sources, and orders placed directly on the Slave account.

E.) Max Daily Account Position Count (Slave)

Max Daily Account Position Count (Slave) works like Max Account Open Position Count (Slave). The only difference is that the count will refresh daily with this option. Please note the Trade Copier is using CET Timezone.

It'll consider all the open and pending orders of your Slave account, from any source, not just those created by the Trade Copier.

F.) Max Daily Symbol Position Count (Slave)

Max Daily Symbol Position Count (Slave) works like Max Symbol Open PositionCount (Slave Symbol). The only difference is that the Slave symbol count will refresh daily. Please note the with this option. Copier is using CET Timezone.

G.) Max Daily Account Position Count Per Master

Max Daily Account Position Count Per Master works like Max Account Open Position Count per Master. The only difference is that the Master order count will refresh daily. Please note the Trade Copier is using CET Timezone.

It doesn't consider orders coming from other Masters, other sources, and orders placed directly on the Slave account.

H.) Max Daily Symbol Position Count Per Master

Max Daily Symbol Position Count Per Master works like Max Symbol Open Position Count per Master. The only difference is that the Master Symbol count will refresh daily with this option. Please note the Trade Copier is using CET Timezone.

It doesn't consider orders coming from other Masters, other sources, and orders placed directly on the Slave account